The ultimate guide to motorbike finance

Looking into motorbike finance for your next bike? Find out everything you need to know about motorbike finance, repayments, bad credit motorbike finance & more.

If you have your eye on a new bike but could use some help affording it, then motorbike finance might be your next port of call. Motorbike finance is a fantastic way to afford your new bike, as it allows you to make a series of manageable monthly payments, so you can focus on riding your new bike as soon as possible..

Today, we’re going to cover everything there is to know about motorbike finance, so you can walk away knowing how it works and look into what your options are. We’ll talk about what motorbike financing and loans are, why you should consider it, how someone with bad credit can get motorcycle finance, and what typical repayments on your motorbike might look like.

What is a motorbike loan?

A motorbike loan, like a personal loan, is where you borrow a set amount of money from a lender to pay for your motorbike. You then pay off the loan, with interest, over a set period of time through monthly repayments. Motorbike loans act similarly to personal loans, where you’ll find you have a choice between a secured or unsecured loan.

Do I have to pay a deposit with motorbike finance?

Motorbikes on finance typically require a deposit. There are instances where a customer can be approved for a zero deposit motorbike finance agreement, but these are quite rare and case-dependent. Bear in mind that again, typically, paying a small deposit or none at all may make future repayments higher.

What is the difference between secured and unsecured motorbike loans?

A secured loan is a type of loan that is secured by collateral, like a motorbike. If say, you can no longer afford the repayments, you’ll typically have to give up an asset to pay it back, which in this case, would be the motorbike itself. This is so lenders can recover their losses, but this may affect your credit score.

An unsecured loan is essentially the opposite - where you don’t need to give up assets if you can no longer afford your bike. Unsecured loans are typically higher in interest rates due to the risk being much greater than a secured loan, which is typically why these types of loans are offered to customers with good credit scores. If you can’t make your regular payments, you may have to pay late fees and other charges, which can harm your credit score. Courts may even issue a county court judgement (CCJ) against you which can harm your potential to borrow money in the future.

What is motorbike finance?

Motorbike finance is an umbrella term that refers to a variety of different financing options that are available for purchasing a motorbike. These agreements can include loans, 0% deposit motorbike finance options, hire purchase agreements, lease agreements, and other financing arrangements depending on your unique circumstances. It’s important to get to grips with how these financing options work, so when you’re faced with them upon getting options back for motorbike finance, check the fine print and ask as many questions as possible.

As a broker, we’ll source relevant lenders depending on your circumstances, who’ll only run a credit check once you’ve consented to one. This is so they can offer relevant solutions based on your circumstances.

Do I have to pay a deposit with motorbike finance?

Motorbikes on finance typically require a deposit. There are instances where a customer can be approved for a zero deposit motorbike finance agreement, but these are quite rare and case-dependent. Bear in mind that again, typically, paying a small deposit or none at all may make future repayments higher.

What is the difference between motorbike loans and motorbike finance?

Motorbike loans and motorbike finance can get mixed up as they’re quite similar in nature. They both involve borrowing money, but there are some differences between these types of motorbike financing options you need to be aware of.

Firstly, motorbike loans can be thought of as your typical personal loan, but geared towards motorbikes (no pun intended). Essentially, you borrow a set amount of money from a lender and make monthly repayments with added interest. Once you’ve settled your final payment, the motorbike is yours.

So how does this differ from motorbike finance? Motorbike finance is a much broader term used to describe the various ways you can pay for your motorbike. Whilst motorbike loans can fall under this umbrella term, there are other options too such as motorbike leasing, hire purchases and more. The motorbike financing agreement you settle on with your lender will typically depend on your financial situation and a variety of factors we’ll cover later on.

Why get motorbike finance?

Riders may choose to get motorbikes on finance for the following reasons:

1. To make your bike purchase affordable

The most common reason people opt for motorbike financing is to make their new motorbike affordable. With motorbike finance, you can spread the cost of your motorbike over a set amount of time, meaning you can pay in instalments as opposed to a bigger lump sum.

2. It’s a flexible option

Lenders can offer various options depending on your circumstances, which makes motorbike financing a potentially flexible option for those seeking it. Some agreements, particularly if it’s a Hire Purchase (HP), may even offer new bikes towards the end of your agreement.

3. It increases your credit score

Motorbike financing, or any kind of financing for that matter, can increase your credit score. So if this has been a worry for some time, then this could help. This is because payment history is a major element in determining your overall credit score, so repaying your loans on time shows potential lenders you are trustworthy and can meet payments on time.

4. You can own the bike

Some agreements give you options when you’re closing in on your last payment. The lender will let you choose to own the bike at the end of your lending agreement, or pick another to finance instead. You may wish to have it as your forever vehicle, or sell it and use the cash to purchase a new bike instead.

Ways to finance a motorbike

There are other ways to finance a motorbike besides going through a specialist in motorbike finance. Whilst we’ve listed some of these ways below, we strongly advise consulting with a financial advisor before making big purchases, as they can help see what’s affordable with your current circumstances.

As brokers, we’ve seen how financing can help those get the bike they want fast, but if you’re curious about other ways to pay for a new bike, here are some options:

1. Cash

If you have the cash to buy a motorbike upfront, then this is a viable option to get your next vehicle. Be sure to check this doesn’t interfere with your other finances, though.

2. Personal loans

Personal loans can be taken through your bank and other lenders. Be advised that these options may not be the most cost-effective for financing your motorbike, but are instead geared towards more general financing options. Plus, with the various options for motorbike financing, you can choose to switch your bike out or return it.

3. Credit cards

Credit cards can be an enticing option to finance a motorbike, especially if you have a 0% interest credit card. You have to be especially careful though because not paying off your credit card before the interest-free period is up can resort in higher monthly repayments.

Who can get motorbike finance?

You must be over the age of 18 to apply and be accepted for motorbike finance and be a UK resident (you can find out more about this on our FAQ page). You must also have regular income from employment or self-employment.

A deposit will be required by most lenders too, though as we mentioned previously, some lenders may make exceptions to this based on your circumstances.

Your credit profile will also be assessed for financing eligibility. Whilst Superbike Loans isn’t a lender, we work with lenders to ensure they can offer motorbike financing options to those who may have bad credit or are simply looking for the lowest APR.

Lastly, whilst it’s not a requirement to hold a full UK driving licence to be approved for motorbike finance, you will need documentation like ID, as well as proof of income to show you can afford to make repayments.

How does bad credit motorbike finance work?

Bad credit motorbike finance works in the exact same way financing for a motorbike does. The only difference is that it looks at applicants with poor credit history, but still wish to purchase a motorbike. Borrowers with bad credit may have been turned down for finance in the past due to missed payments, low credit scores and the like

As a leading motorbike finance broker, we ensure you’re put in touch with lenders who’ll look at a borrower’s situation currently, to determine if they can afford repayments with the circumstances as they are now.

If you’re approved for finance, then you’ll make monthly repayments just like you would regularly. Motorbike finance specifically for bad credit may come with slightly higher interest rates, as lenders may view borrowers with bad credit as ‘high risk’. However, by meeting your repayments as scheduled, you can improve your credit score over time and qualify for lower interest rates in the future.

How are credit scores calculated for motorbike finance?

When calculating your credit score for motorbike finance, credit reference agencies (CRAs) such as Experian, will calculate your score based on various factors, and then feed this back to a broker who then uses this information to source relevant lenders. Soft credit searches are conducted by brokers like ourselves to view your credit report as part of an identity check, but hard credit searches will be done when you actually go ahead with a finance option

Here are some elements used to calculate your credit score for motorbike finance:

- 1. Payment history

- 2. Credit usage ratio

- 3. Length of credit history

- 4. Types of credit

- 5. Recent credit applications or ‘hard’ checks

CRAs will then give you a score from 0-999, with the higher end of the scale indicating ‘better’ credit. Credit scores are rated Excellent, Good, Fair or Poor.

What do motorbike finance repayments look like?

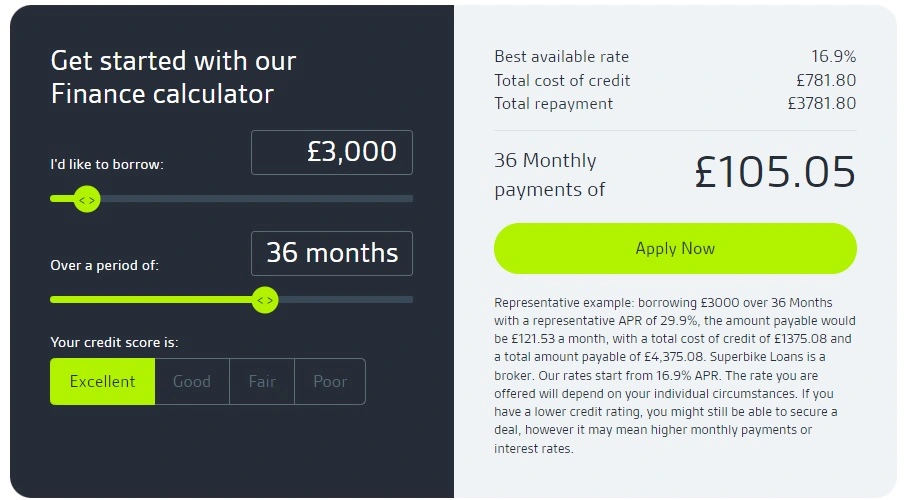

A motorbike finance calculator can help show what your future monthly repayments could look like, depending on how much needs to be borrowed over a set period of time.

For example, a borrowing amount of £3,000 over a 36-month period with an excellent credit score, could mean your monthly payments are £105.05. This amount will obviously vary depending on the lender you go for, and what your credit score is.

If you do get motorbike finance, but find you’re struggling to meet your repayments, it’s worth contacting Superbike Loans, or your lender directly, to see what adjustments can be made to manage debts.

We hope this guide has given all the information you possibly need to know about motorbike finance and why it’s beneficial. Want to finance a new bike? Apply for motorbike finance now or contact Superbike Loans for more information on our financing options and any other questions you may have.